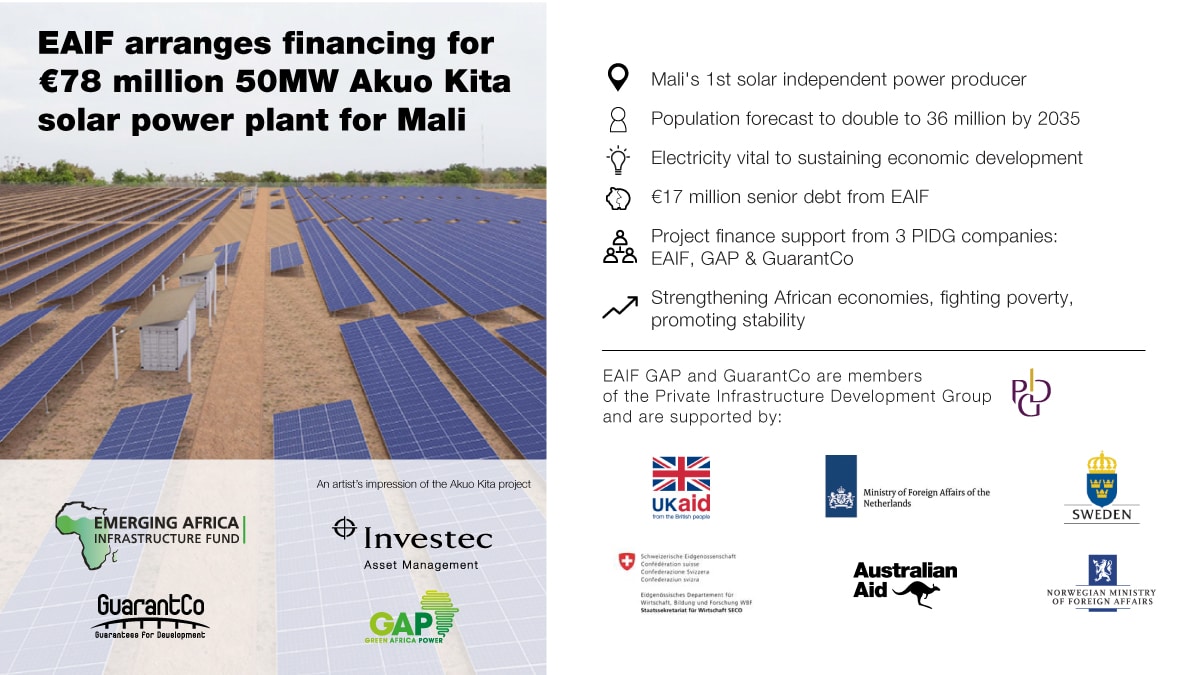

Emerging Africa Infrastructure Fund leads and closes financing of €78 million 50MW in Akuo Energy’s solar plant in Mali

The Emerging Africa Infrastructure Fund (EAIF), which is part of the Private Infrastructure Development Group (PIDG), and Akuo Energy, the leading French green IPP, today announce the signing of financing of the Akuo Kita Solar power plant, to be built at Kita in southern Mali.

- Largest solar power plant yet built in West Africa and first solar IPP in Mali

- Key roles for PIDG companies EAIF, GuarantCo and Green Africa Power

- EAIF Mandated Lead Arranger

- First French-speaking Africa MLA for EAIF

- Permanent and construction jobs created

It will be the first photovoltaic power station in Mali owned and run by a private sector independent power producer. Two other PIDG companies, GuarantCo and Green Africa Power (GAP) contributed to the project financing.

The €78 million, 50MW project includes transmission infrastructure connecting into the local electricity grid. It will be the largest solar farm yet built in West Africa. Akuo Kita Solar will sell its power to Electricité du Mali SA, the national utility, under a 28-year power-purchase-agreement.

Up to 400 people, including 20 managers, will be employed during the 12-month construction period. When operational, the Kita plant will have 30 permanent staff, all of whom are expected to be from Mali.

EAIF, the Mandated Lead Arranger (MLA) on the Akuo Kita Solar project financing, has arranged the senior debt facility for a total of €54 million over 15 years. EAIF’s share of the debt package is €17 million. The transaction was co-arranged with the Banque Ouest Africaine de Développement (BOAD). The other senior debt providers are FMO, the Dutch development finance institution and Banque Nationale de Développement Agricole (BNDA). GAP is providing a mezzanine facility of €8 million over 20 years and GuarantCo a Debt Service Reserve Account (“DSRA”) guarantee. The project marks EAIF’s first Mandated Lead Arranger role in a French-speaking African country.

PIDG is funded by donors from seven countries (UK, Switzerland, Australia, Norway, Sweden, Netherlands, Germany) and the World Bank Group. In the case of EAIF, funding comes from the governments of the UK, The Netherlands, Sweden and Switzerland, as well as private sector banks, the German development finance institution, KfW and its Dutch equivalent, FMO. GuarantCo is funded by the governments of Australia, the UK, Sweden, Switzerland and The Netherlands. And GAP is funded by the UK and Norway.

Akuo Energy is recognised for its expertise in project design and production technologies that bring many benefits to the communities it works in. Akuo Energy aims to establish a portfolio in Africa of around one gigawatt in the medium term.

EAIF Executive Director, Emilio Cattaneo, says Mali has realised that its abundance of sunshine makes solar power a critical asset in accelerating the country’s rate of electrification.

“Mali’s population is expected to double from c18 million to around 36 million people by 2035. It is estimated that fewer than 5 million people have access to electricity. As the population grows and becomes more urban, lifting the rate of electrification will be essential to social cohesion, stimulating economic activity, alleviating poverty and helping secure political stability. Solar generation facilities have the ability to be built quickly and in numerous locations. Akuo Kita Solar has seen the potential and I hope many other developers follow its lead,” says Mr Cattaneo.

GuarantCo Chief Executive Lasitha Perera said: “Akuo Kita Solar is the second power project in Mali to benefit from a DSRA guarantee from GuarantCo this year and demonstrates the critical role that credit enhancement can play in improving the viability of essential infrastructure. GuarantCo is delighted to have partnered with its fellow PIDG companies, EAIF and GAP, to deliver this ground-breaking project that highlights the depth and breadth of the PIDG.”

EAIF is managed by Investec Asset Management (IAM), one of the largest third-party investors in private equity, credit, public equity and sovereign debt across the African continent.

Head of EAIF at Investec Asset Management, Nazmeera Moola, says: “As Mandated Lead Arranger, we were able to move quickly to carry out all the due diligence, attract other debt providers and conclude negotiations. Our ever-deepening experience of energy projects means we can save huge amounts of time for our clients and financial partners. We are making beneficial and efficient use of the funds provided by our donors and lenders.”

GAP Executive Director Peter Hutchinson said: “The successful closing of the Akuo Kita financing demonstrates the need for a blend of different financial instruments. This could serve as a good template for future solar schemes.”

GAP received investment advice from EISER Infrastructure Partners LLP.

Akuo Kita is EAIF’s second project in Mali. In June 2017, it announced its backing for Albatros Energie Mali, which is building a 90MW HFO-fueled power station in the country.

Advisers to the lending group

Legal DD: Norton Rose. Local counsel: Jurifis. Technical and E&S DD: Sgurr Energy. Insurance DD: Marsh. Model and tax audit: BDO

The Emerging Africa Infrastructure Fund, GuarantCo and Green Africa Power are funded by: