Our impact

Our investments enable the delivery of climate-resilient, inclusive infrastructure projects that transform economies and improve lives in Africa and Asia. Their impact can often be felt for decades, by people and businesses far beyond the original project location.

Above all, quality infrastructure enables people and businesses to plan for the future with confidence.

The projects we fund contribute to political and economic stability, strengthen regional integration and trade, build resilience and human capital and stimulate productivity and growth.

EAAIF is creating access to low carbon infrastructure and taking action on both mitigation and adaptation to accelerate African industrialisation and close the energy access gap, whilst supporting the global transition to net zero.

We have invested $500m in renewables and generated over 1000MW of clean energy.

We invest with a gender lens to optimise impact for women and girls and we are increasingly incorporating Equality, Diversity and Inclusion criteria into our investment strategy to be more intentional about the impact we create for the most marginalised communities.

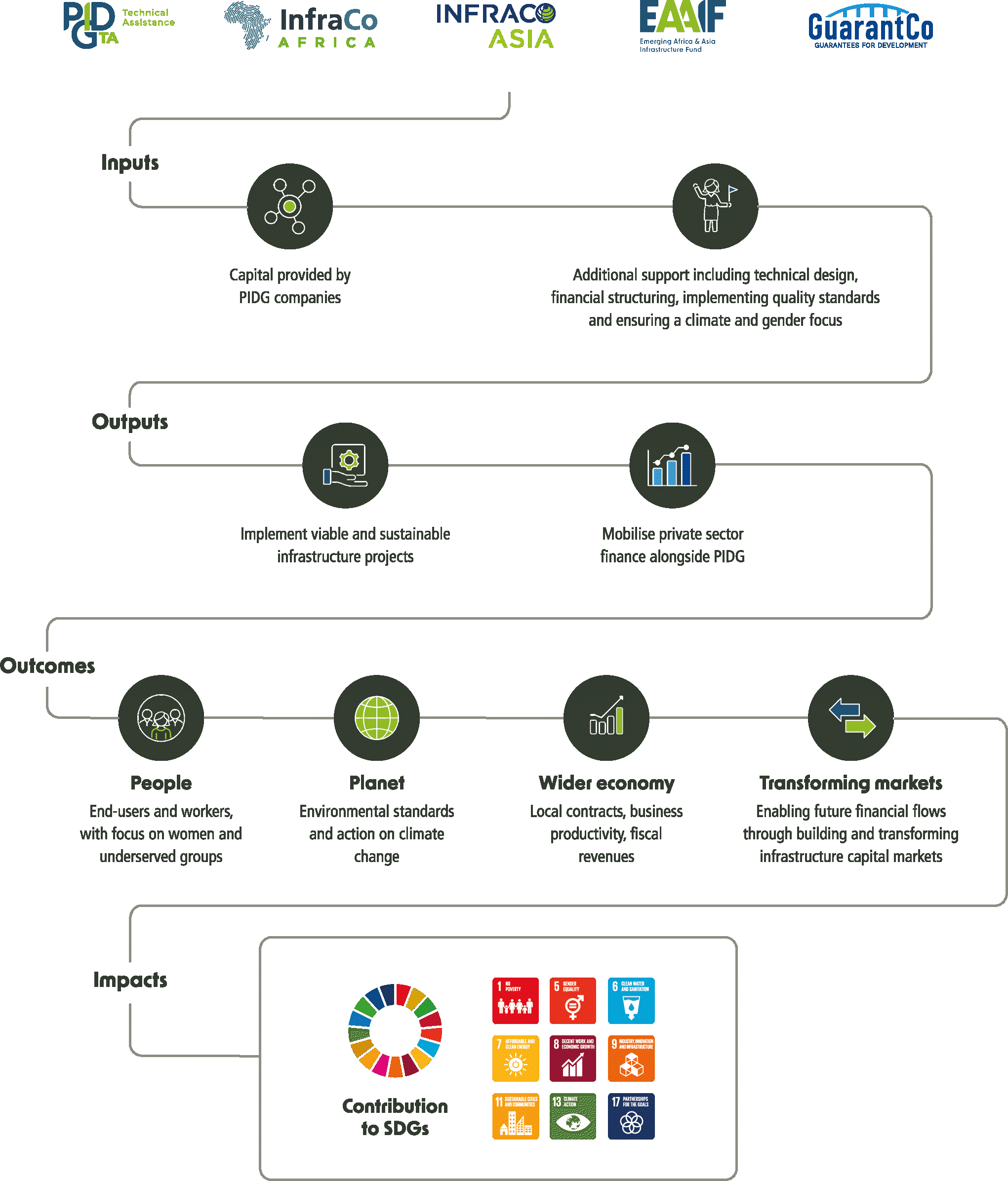

Our approach is guided by the Private Infrastructure Development Group Theory of Change and is designed to make a significant contribution towards the attainment of the United Nations Sustainable Development Goals.

We are one group with a single mission. We get infrastructure finance moving and multiplying – accelerating climate action and sustainable development

Fig. 1: PIDG Theory of Change

We measure our impact at project level in terms of:

People impacted – 147.7 million people are benefitting from EAAIF-funded projects

Jobs created – directly and indirectly through the value chain; short and long term; human capital development through skills-building

Fiscal contributions – directly and indirectly through the value chain

Improved access to infrastructure in terms of affordability and inclusion (e.g. people with disabilities or other marginalised communities)

Advances in gender equality

Climate resilience – developing low carbon pathways to growth

At corporate level, we measure our impact in terms of:

Capital raised and deployed

EAAIF raised US$ 294m in additional debt facilities in 2023 – over half of the Fund’s target to raise $500 million by 2025. We plan to invest US$700 million in infrastructure over the next few years.

Over the past 20 years, the Fund has successfully concluded 9 rounds of debt raising, with debt provided by a mix of DFIs, commercial lenders and institutional investors with a total value in excess of USD 1.68bn.

Retained earnings are over US$ 100m and have been recycled back into the Fund

Committed >US$2.1bn of debt capital into 96 projects since 2001.

Capital mobilisation

$14 billion of private capital

Demonstration effect – giving confidence to other investors to enter a market or sector, or back a new technology