The Emerging Africa & Asia Infrastructure Fund (EAAIF) was established as the first company within the Private Infrastructure Development Group (PIDG). Managed by Ninety One, we provide long-term commercial debt to deliver inclusive and impactful infrastructure projects in Africa and Asia.

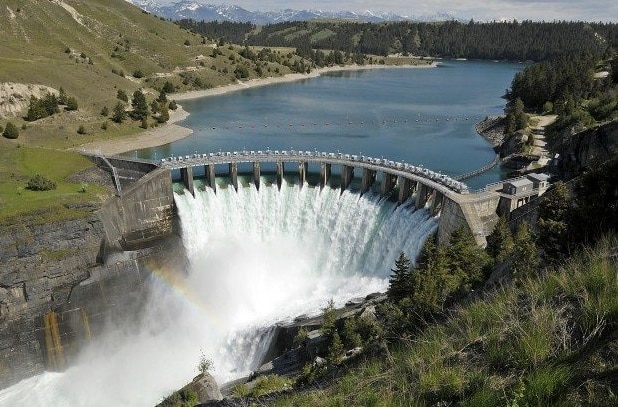

Kinguele Hydro

$23m of debt to build and operate a 35 MW hydro power plant in Gabon. This will increase access to reliable electricity to 97k consumers, and increase productivity for firms to create indirect jobs and avoid 186k tCO 2e per year.

Programme Electricité Pour Tous (PEPT) Social Bond

$30m provided to anchor a receivables securitisation local currency bond of XOF 60 billion (c.$100m) to fund the continuation and acceleration of the national Electricity for All Programme Electricité Pour Tous (PEPT) electrification programme in Côte d’Ivoire (LMIC and FCAS). The programme will add 400k new connections in the next two years which is expected to provide first time electricity access to 2m low income rural households.

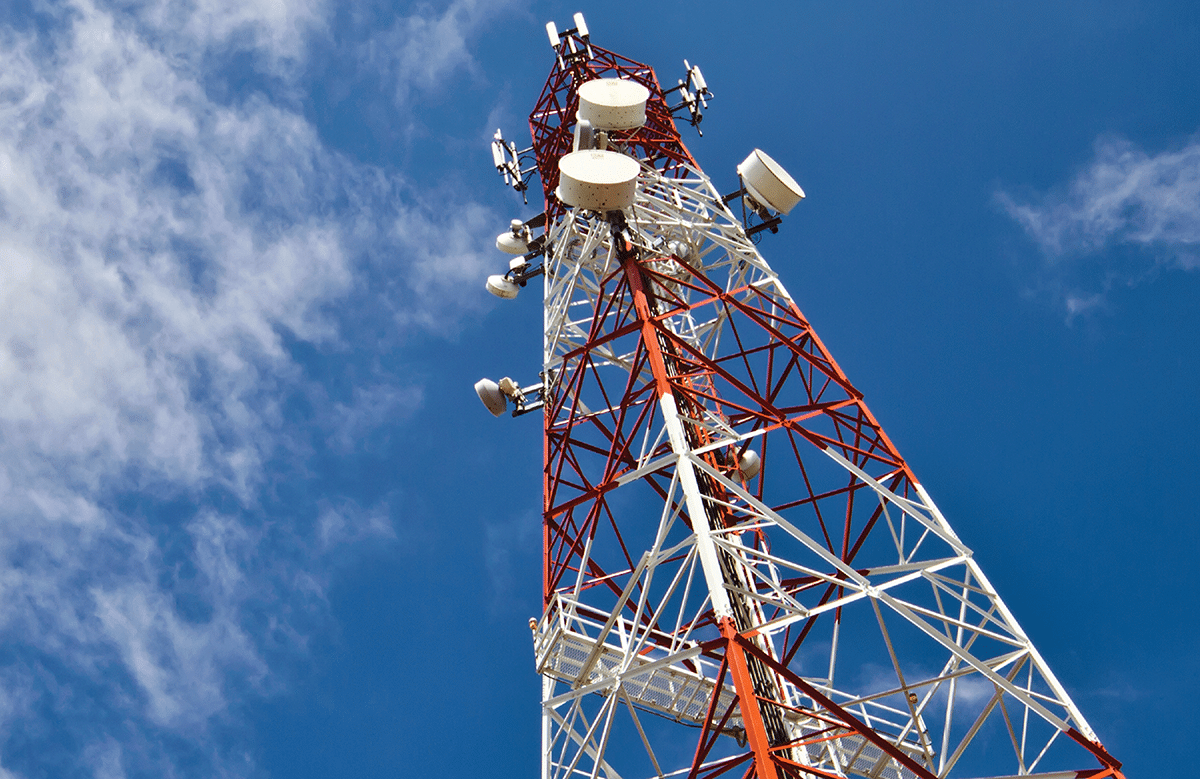

Eastcastle

$30m of debt, provided to Eastcastle to build 767 new towers and rehabilitate 275 existing towers across the Democratic Republic of the Congo (DRC) (LDC and FCAS). This will improve access to mobile voice and internet services for 1.9m customers improving quality of life and enabling economic growth through enhanced productivity.

Sector Focus

Applying for project support

If you are looking for debt finance for an infrastructure project in sub-Saharan Africa please talk to us.

EAAIF mainly supports private sector infrastructure projects to create new or expand existing facilities. We welcome enquiries from companies in Africa and worldwide that want to grow their businesses in sub-Saharan Africa and share our commitment to the continent and its peoples. Enquiries are also welcome from financial advisers and specialist consultants.

Latest news

EAAIF and Ninety One back Verdant to acquire pioneering wind power and storage project in the Philippines

Emerging Africa & Asia Infrastructure Fund (“EAAIF”) and Ninety One’s Emerging Market Transition Debt (“EMTD”) strategy jointly commit $30 million to accelerate the Philippines’ transition to a clean energy future. The transaction breaks new ground for all parties involved — Verdant Energy, EAAIF, and Ninety One’s EMTD strategy — representing their first engagement in the… Read more »

EAAIF commits EUR 40 million of sustainability-linked financing to support the upgrade and expansion of Cabo Verde’s national airport network

Investment will finance development across seven airports, strengthening connectivity, tourism, and airport environmental objectives. Transaction reinforces EAAIF’s role in mobilising long-tenor, sustainability-linked capital for essential transport infrastructure in climate-vulnerable countries. London, 27 January 2026: The Emerging Africa & Asia Infrastructure Fund (EAAIF), a Private Infrastructure Development Group (PIDG) company, managed by Ninety One, has committed… Read more »

EAAIF and Ninety One commit $30 million to WIOCC’s expansion, accelerating digital connectivity in Africa

Investment to expand fibre networks, data centres, and last-mile connectivity, bridging Africa’s digital divide Sustainability-linked loan ties financing costs to green performance targets, promoting climate-resilient digital growth London, December 15: The Emerging Africa & Asia Infrastructure Fund (EAAIF), a Private Infrastructure Development Group (PIDG) company, managed by Ninety One, today announced a $15 million investment… Read more »

Our funders

Biomass financing by EAIF to deliver 46MW renewable energy plant in Cote D’Ivoire

“EAIF rapidly moving towards green energy loan portfolio of 1000MW” The Emerging Africa Infrastructure Fund – a Private Infrastructure Development Group (PIDG) company – announced on 10th June that it is lending €30 million to support the construction of a new €232 million, 46MW, biomass power station in Cote D’Ivoire. Located at Ayebo, 100km east… Read more »