The Emerging Africa & Asia Infrastructure Fund (EAAIF) was established as the first company within the Private Infrastructure Development Group (PIDG). Managed by Ninety One, we provide long-term commercial debt to deliver inclusive and impactful infrastructure projects in Africa and Asia.

Raxio Data Centres

$33m of debt to finance the construction and operation of data centres in Uganda (FCAS and LDC), Ethiopia (LDC and FCAS), the Democratic Republic of the Congo (LDC and FCAS), Côte D’Ivoire (LMIC and FCAS), Mozambique (FCAS and LDC), Angola (LDC) and Tanzania (LDC). This will improve internet speed for business customers to enable economic growth. 70% of proceeds will be allocated to FCAS countries and 60% to LDC countries.

Dakar Toll Road

$50m of debt to support the extension and upgrade of the A1 motorway in Senegal (LDC) which connects the city of Dakar to the airport. This will enable the efficient movement of passengers and trade, and is set to lead to economic growth and indirect job creation.

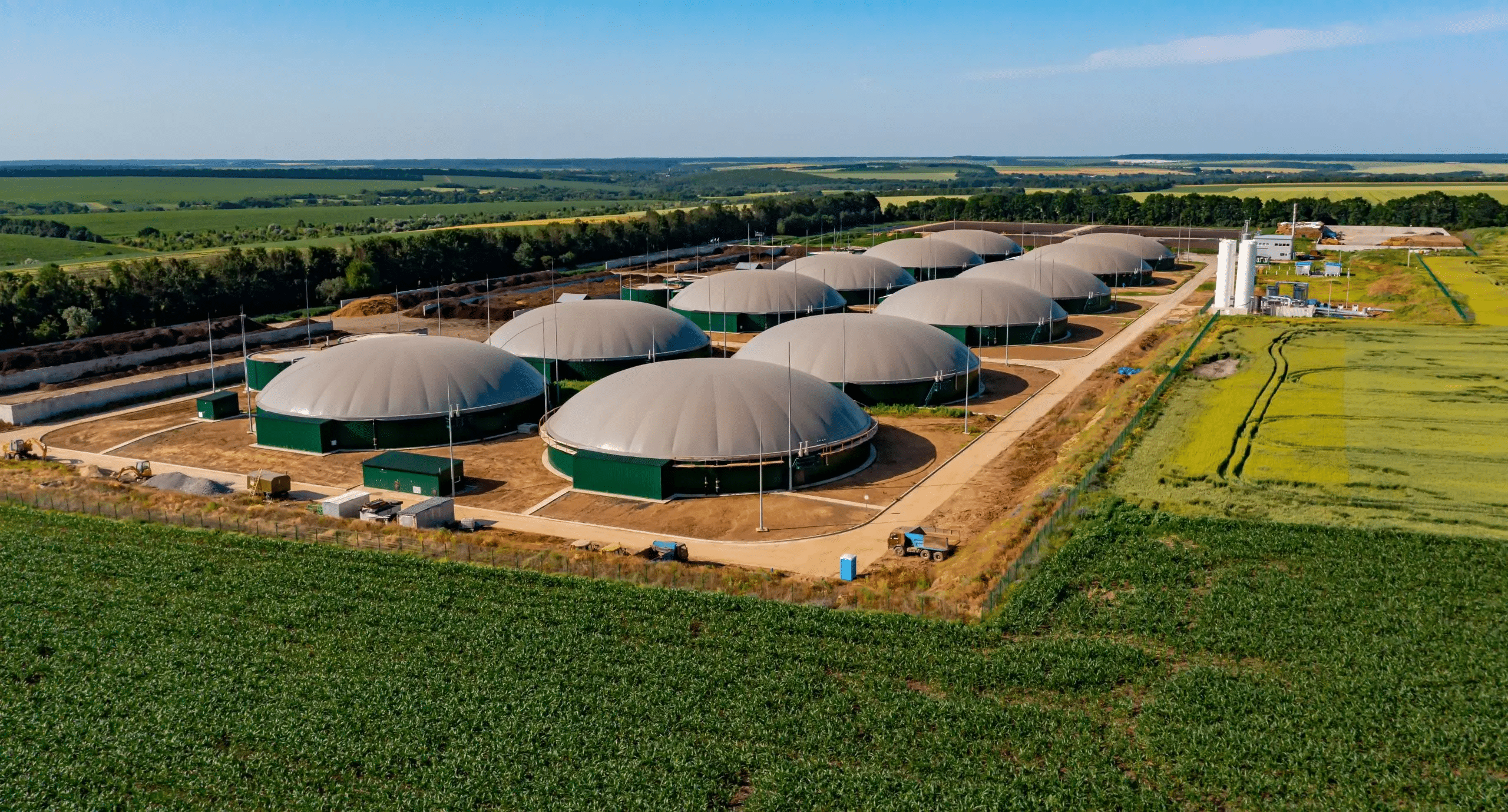

Biovea Biomass Plant

$42m of debt to support the construction and operation of a 46 MW biomass plant in Côte D’Ivoire (LMIC and FCAS). This will improve income generation for 12k outgrowers, while increasing access to reliable electricity to 743k consumers and avoiding 120k tCO 2e per year.

Sector Focus

Applying for project support

If you are looking for debt finance for an infrastructure project in sub-Saharan Africa please talk to us.

EAAIF mainly supports private sector infrastructure projects to create new or expand existing facilities. We welcome enquiries from companies in Africa and worldwide that want to grow their businesses in sub-Saharan Africa and share our commitment to the continent and its peoples. Enquiries are also welcome from financial advisers and specialist consultants.

Latest news

EAAIF and Ninety One commit $30 million to WIOCC’s expansion, accelerating digital connectivity in Africa

Investment to expand fibre networks, data centres, and last-mile connectivity, bridging Africa’s digital divide Sustainability-linked loan ties financing costs to green performance targets, promoting climate-resilient digital growth London, December 15: The Emerging Africa & Asia Infrastructure Fund (EAAIF), a Private Infrastructure Development Group (PIDG) company, managed by Ninety One, today announced a $15 million investment… Read more »

EAAIF announces second XOF 10 billion commitment to Côte d’Ivoire’s landmark social bond, supporting electricity access for millions

Issuance will finance 400,000 last-mile connections, building on 2.2 million households already connected. EAAIF’s second commitment to the programme underlines the Fund’s role developing innovative bond issuances in underserved regions. London, December 9: The Emerging Africa & Asia Infrastructure Fund (EAAIF), a Private Infrastructure Development Group (PIDG) company, managed by Ninety One, has committed XOF… Read more »

EAAIF secures USD $100 million debt facility from Export Finance Australia

The financing underscores EAAIF’s pivotal role as a gateway for new, diverse capital to accelerate green energy transitions and economic resilience in emerging markets. EAAIF’s two decades of expertise align with Australia’s development impact ambitions, backing businesses overseas that boost access to sustainable infrastructure, economic productivity in underfunded areas and support the energy transition. London,… Read more »

Our funders

Biomass financing by EAIF to deliver 46MW renewable energy plant in Cote D’Ivoire

“EAIF rapidly moving towards green energy loan portfolio of 1000MW” The Emerging Africa Infrastructure Fund – a Private Infrastructure Development Group (PIDG) company – announced on 10th June that it is lending €30 million to support the construction of a new €232 million, 46MW, biomass power station in Cote D’Ivoire. Located at Ayebo, 100km east… Read more »